About

PPLI Asia Pte. Ltd. is a Singapore-based boutique consulting company providing strategic advisory services and specialized workshops and conferences for Family Offices, Private Banks, Insurance Companies, Fund Managers, Ultra-High-Net-Worth (UHNW) Individuals, Professional Advisor, and Fiduciary Partners.

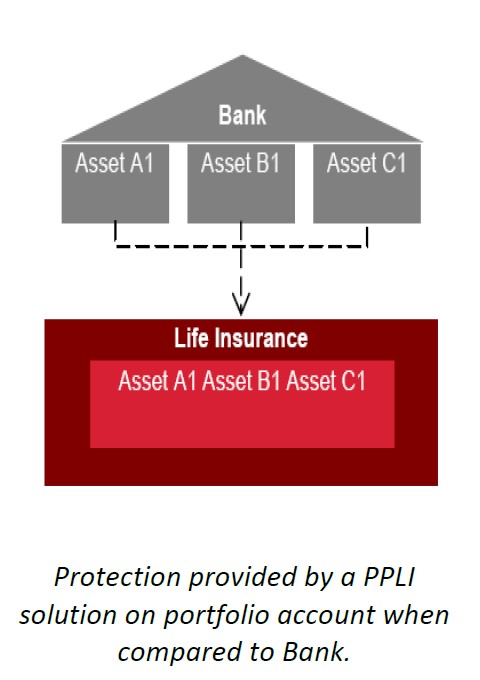

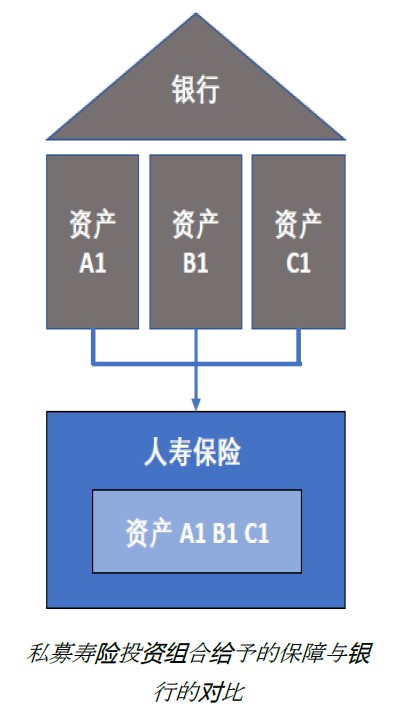

Leveraging Singapore’s position as a leading global financial centre, PPLI Asia offers independent and bespoke advisory solutions in Private Placement Life Insurance (PPLI), cross-border wealth and estate structuring, and strategic business development. The firm’s expertise bridges regulatory, fiduciary, and commercial considerations to support clients in achieving sustainable, compliant, and globally aligned wealth strategies.

In addition to its advisory practice, PPLI Asia curates high-level educational programmes, workshops, and conferences that promote thought leadership, technical knowledge sharing, and industry collaboration among senior practitioners and institutional stakeholders in the private wealth sector.

With a focus on integrity, professionalism, and discretion, PPLI Asia continues to be a trusted partner to leading institutions and wealth professionals across Asia and beyond.

-

Wong Keng Chun

Executive Director

served as Chief Business Officer of AXA Life Singapore, Sales Director of Swiss Life Singapore, CEO of Great Eastern Life Indonesia, CEO/Managing Director of NMBf Merchant Bank Fiji, Director of MBf International, Sydney (an ASX company) , Vice President of MBf Asia Capital Corporation Pty Ltd, Hong Kong, amongst others. He also founded two registered fund management companies in Singapore.

-

See Seen Lee

Sales Director

is an Actuary by training and started in the traditional space of calculating reserves, reporting them to regulators, pricing insurance products and putting all this work into a computer programme. A Fellow of the Faculty of Actuaries in UK in 2005, he worked in Prudential Scotland before moving to Singapore to work for AIA and AXA. He then ventured into risk management with Aviva and later on as the Head of Risk Management for Tokio Marine, Singapore. See Seen holds a BSc (hons) Actuarial Mathematics and Statistics (1st class), Heriot-Watt University, Scotland. He is currently involved in the strategic planning of the company.

-

Sharon Foo

Finance, Director

has extensive experience in accounting, external audit, taxation, corporate secretarial and business management. He is a chartered accountant and tax practitioner by training with various professional firms. His past professional exposure in various industries contributed significantly to his corporate career development.

-

Cheng Hock Chi

Chief Operating Officer

qualified as a Fellow of the Faculty of Actuaries in 1985, after graduating from the Heriot-Watt University in 1981. He joined Great Eastern Life Assurance in Singapore that year, where he spent 21 years. He has also served on the Council of the Singapore Actuarial Society in various capacities – Council Member, Honorary Secretary, Vice-president and President.

-

Be Part

Of Our

Story!

Events

PPLI Forum Asia 2025

Saturday, 20 September 2025Venue: Sheraton Towers Hotel, Singapore

Whether you're a seasoned practitioner or new to the field, PPLI FORUM ASIA 2025 delivered a unique opportunity to stay ahead of industry trends, share experiences, and build lasting professional relationships in an environment designed for real impact.

Meaningful networking opportunities with industry pioneers, wealth planners, legal advisors, Family offices , asset managers and insurance specialists.

Actionable takeaways that equipped participants with practical tools, strategies, and insights to navigate the evolving landscape of wealth structuring and legacy planning.

PPLI Asia Forum 2025 in Pictures

The HED Conference Asia

Firday, 19 September 2025Venue: SGX Auditorium, Singapore

PLLI Asia was proud to serve as the co-organizer of the HED Conference of Asia, held today, 19 September 2025, at the SGX Ventre in Singapore.

This Hedge, Equities & Derivatives event brought together approximately 200 leading Family Offices and Fund Managers from China, Hong Kong, and Singapore, offering a dynamic platform for networking and sharing insights on alternative inverstments, emerging markets trends, and growing relevance of Fiduciary solutions.

As a key industry player, PPLI Asia remains committed to fostering dialogue and innovation in the wealth management space across Asia.

HED Conference Asia 2025 in Pictures

PPLI Forum Asia 2024

After a successful Asia Forum in 2023 and with the response and feedback from friends and business associates in the industry, we organized the 2024 event to share ppli solutions in an everchanging financial landscape that are of significance to hign-net-worth family's financial advisors.

PPLI Forum Asia 2024 in Pictures

PPLI Forum Asia 2023

The inaugural PPLI Forum Asia 2023 was held at the Sheraton Towers Hotel, Singapore from Nov 20th to 22nd 2023. This international event allowed participants, mostly from Asia, to learn of the mechanics of structuring a PPLI solution; HNW inheritance and Tax, plus the latest trends and changes as wealth management continue to grow in our increasingly important region.

PPLI Forum Asia 2023 in Pictures

Our Amazing Team

Kimberley Wong

Business Development

Lawrence Oei

Chief IT & Security Enabler

Katherine Lee

Director, Compliance

Lailing Shu

Manager, Client Acquisition Support

Stephanie Lam

Director, Sales

Zhang Xue Fei

China Desk